Even the most beloved brands like Apple or Coke find that the shopper journey is a battlefield, where not all purchases are  “safe”. As people research their upcoming purchases online, or find themselves in different need states, brands come and go in and out of consideration, right up until the moment of truth at the shelf. Sometimes a consumer discovers a brand purely by accident as they are searching generically for information. You can lose a third or more of purchases you were supposed to win and you can snatch just as many purchases back from competitors…if your marketing is properly tuned. (See the end of this blog for references t0 supporting research.)

“safe”. As people research their upcoming purchases online, or find themselves in different need states, brands come and go in and out of consideration, right up until the moment of truth at the shelf. Sometimes a consumer discovers a brand purely by accident as they are searching generically for information. You can lose a third or more of purchases you were supposed to win and you can snatch just as many purchases back from competitors…if your marketing is properly tuned. (See the end of this blog for references t0 supporting research.)

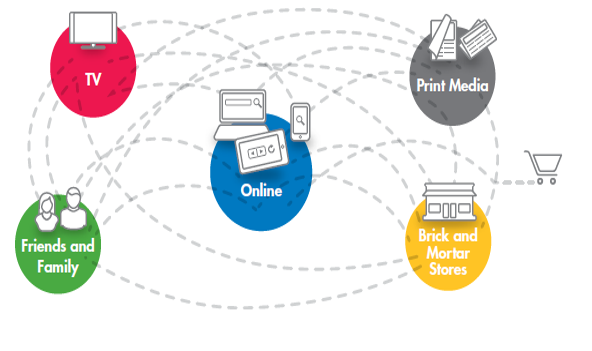

The slippage between the brand preferred and the brand bought can only be understood if you build a path to purchase perspective into your brand tracking and marketing efforts.

Why doesn’t brand equity completely predict the purchase? Why would a consumer even be doing research online if they are sure of the brand they will buy? Consider smartphones…that is really a four dimensional decision for a consumer. What brand of equipment will I buy? Who will the service provider be? What retailer will I buy from? What websites will be my main, go-to sites for information? Even if a consumer “knows” they want a iPhone, they are NOT likely to be certain in all four dimensions and that creates the possibility that the shopper will learn about Samsung or some other brand. This creates the potential for a slip to occur between the certainty of a preferred brand and what actually gets bought. Adding to the chaos is that most consumers have brand preferences but not exclusive loyalty to one brand.

When you begin to look at purchase outcomes through this lens you will learn that the path to purchase is a marketing battlefield.

When we look at brands from a traditional brand tracker perspective, we focus all our energies on understanding what brand a consumer prefers, the degree to which they are attached to that brand, and what perceptions or actions drive that attachment. All important, but now we see that this accounts for, at most, two-thirds of purchase outcomes. The rest is explained by what happens in the path to purchase and how a marketer performs on the battlefield. Marketers and their research teams needs to shift focus to understanding the battlefield, away from seeking marginally better ways of measuring brand equity.

When you (the marketer), adopt this new approach, here are 7 things that you will do differently:

- You will increase your investment in programmatic, desiring to target ad impressions based on the intersection of shopping moments and segments/personas (e.g., “I want to reach those celebrating a healthy lifestyle as they are acquiring shopper information”.)You will find digital signals that indicate someone is in a shopping process and target ad impressions to them programmatically.

- You will realize the importance of first party data and do everything possible to build your reach through your website, lookalike modeling using 3rd party data, and partnerships that allow for pooling first party data. You will break social media conversations by segments of consumers using profile matching. Then you will place ads throughout the web and social channels by finding this audience wherever they are.

- Give content marketing new purpose. Your content becomes an attractor to your website and it must deliver more than messages about your brand performance. It must be informative and entertaining, connecting with values that you and your key consumer segments share. You will consider collaborative shopper marketing programs where content is coordinated across the manufacturer and retailer websites.

- Integrate data assets to compete on analytics. You will break down silos between shopper data, clickstream, and other sources, to create the strongest possible data model about individual users and how to best communicate with them to achieve desired outcomes.

- You will change your agency selection criteria. Media agencies will now need to demonstrate that they have effective frameworks and media placement tools for building brands at all points along the path to purchase.

- Change organizational models. Siloing consumer vs. shopper perspectives no longer works. You might even bring more of the media strategy and execution in-house (we see this with the rise of demand side platforms and private trading desks.)

- Last but not least, you will change your marketing research priorities. No longer will path to purchase research be the domain of shopper insights specialists. Now, it will integrate into brand trackers, campaign trackers, and basically everything you do. You won’t just measure brand consideration, now you’ll want to know when brand consideration forms, when it dissipates and what the conversion rate is depending on when consideration forms. You’ll be surprised to learn how many purchases come from paths where your brand was NOT considered at the start but became discovered during the shopper research phase. You will then want to understand the media touchpoints that map to each stage in the journey so you can dial up efforts against the points where your brand is experiencing slippage. You will create new brand performance metrics that reflect this new model.

As we head into 2015, two of the most powerful transformational forces for marketing productivity are the rise of programmatic ad buying and data driven marketing. A path to purchase framework and data driven marketing are perfect partners. The framework provides the understanding behind the math and data-driven advertising technology activates the framework.

===================================================================================

Postscript: evidence about the breakdown between brand equity and purchase outcome

- In the 1970s, The Hendry Corporation proves that loyalty is a distribution of purchase probabilities, not an “either/or” classification.

- In 1995, POPAI produces evidence that 70% of purchase decisions (down to the brand level) are made in-store. (Consistent with R&D I spearheaded when I was at Synovate, now IPSOS)

- In 2009, McKinsey issued a white paper on the consumer decision journey, finding that brand consideration can form and dissipate in the middle of the process, as shoppers do their shopper research online.

- In 2009 Nielsen/BASES found that in-store exposure had become the largest source of new product brand awareness, even higher than TV

- In 2009, in cooperation with me as ARF Chief Research Officer, Catalina showed that for bottled water and laundry detergent, shoppers buy their preferred brand only half to two-thirds of the time

- In 2013-2014, research I conducted with InsightsNow on behalf of AOL found that often brands that are bought are FIRST CONSIDERED when they are discovered via the pre-shop research phase. We also found that a high percent of always on people are constantly browsing in a given category for entertainment value without shopping purpose but that this can then trigger a shopping journey.

- (Please contact me if you need references/URLs, etc.)

Joel,

Great post. We’ve been working on some thoughts here and have a white paper/blog post coming up that will add to the conversation.

Thanks for posting. This is a great article.

Today i spent 300 $ for platinium roulette system , i hope that i will make my first $$ online