Marketers now know that prior years of brand building can have a much bigger impact on current sales than previously thought.

The answers came from a breakthrough study for Ally bank designed by MMA Global called “Brand as Performance” that I helped to create. A single source, ID level approach that brought together ad serving, CRM conversion data, and brand surveys, onboarded to a common backbone (TransUnion for this study) with persistent IDs so we could study long term effects. (I co-presented this with the head of analytics at Ally Bank at the ARF Analytics and attribution accelerator conference this week).

The key unlock was the idea that customers and non-customers fall into two sub-groups: those who are favorable to your brand and those who are non-favorable.

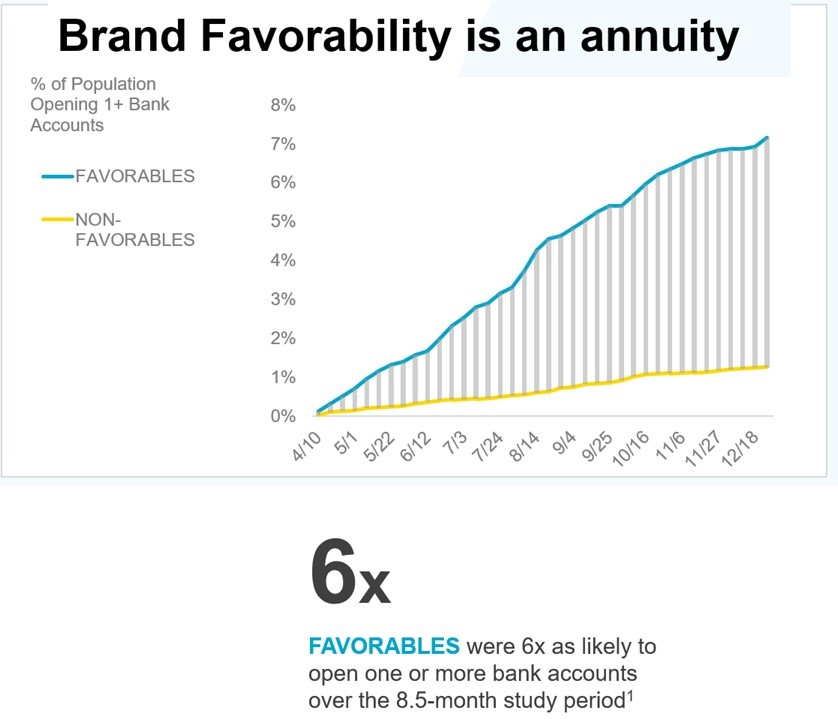

Favorables to Ally* opened new accounts at 6 TIMES THE RATE vs. non-favorables. This 6X ratio was maintained up through 6 months after the end of the ad campaign (9 month study period in total).

Now let me add powerful implications:

1. Favorability towards Ally had an estimated half-life of about 1 ½ years. The growing absolute gap in conversions over time was converted into a half-life for favorability using Markov analytics. (Otherwise, if favorability rapidly decayed into non-favorability, the gap would have deteriorated).

2. Favorable non-customers created a 3-5X higher rate of winning new customers (vs. non-favorables) and reducing CAC by more than half. We also showed that Brand advertising could convert non-favorables into favorables among non-customers.

3. Therefore, the favorables you create today are likely to pay off for years to come and brand building dollars are an essential part of driving long-term brand growth.

Implications for advertising strategy.

The research for Ally changed my worldview. In prior writings, using motor vehicle sales as an illustration, I noted that if only 5% of drivers are in the market for a car at a point in time, why advertise much to the other 95%? I now have the answer. You need to build brand favorability BEFORE the shopping journey so when that consumer comes into an active shopping stage, their journey will be brand led, leading to a big advantage in the outcome you desire. (This advantage from journeys that start with branded search vs. generic search I was able to quantify using #DISQO behavioral tracking data.)

What “mortgaging the brand’s future” really means.

Prof. Kevin Lane Keller has an intriguing definition of brand equity…”the differential advantage by knowing the brand.” I love it for its brevity and capturing the essence, but it misses a quantitative structure which this research now provides. The pool of favorable non-customers is your primary source for new customers. Performance marketing wins new customers by depleting this reservoir which then must be replenished with brand advertising by turning non-favorables into favorables. If you do not fully replenish, this study proved that your CACs will trend up and future conversions of non-customers into customers will slow down to a trickle. A depleted reservoir is the result of too much performance marketing; that is mortgaging the brand’s future.

Implications for marketing research and analytics.

Favorability is meant to be analyzed at a subgroup level. We created a score for a respondent across consideration, points in a constant sum, attribute ratings, and a direct liking question. Then finetune the algorithm to maximally differentiate conversion rates. We strongly suggest mimicking this approach in your brand trackers. In particular, I cannot emphasize enough the power of adding a constant sum question to your research.

Second point…the carry over effects of your advertising are not limited to time bank…a geometrically declining value to your advertising in the weeks after the ad was seen. The biggest effect is if your advertising converts someone into becoming favorable towards your brand. Our evidence is that favorability towards a brand lasts well over a year. The way we determined this was by using a Markov modeling approach to replicate the cumulative conversion curves. The best fitting retention rate of favorable non-customers remaining in that state for a bi-month was the input to an exponential decay function to calculate half-life. I contend this is a far superior approach to trying to reinterview the same respondents 6 months later, which is actually not very practical today. (Contact me if you are interested.)

If you are interested in how a brand vs. performance study is conducted, please contact me (joel@rubinsonpartners.com).

Also stay tuned for results from another brand as performance study that was conducted for Kroger.

*Ally ”Brand as Performance study led by the MMA, in conjunction with TransUnion (data integration, modeling, and analysis partner) and Dynata (survey partner).