“If this business were split up, I would give you the land and bricks and mortar, and I would take the brands and trade marks, and I would fare better than you.”

— John Stuart, Chairman of Quaker (ca. 1900)

Certainly Mr. Stuart was right, but the irony is that few marketers systematically try to link brand-building efforts to changes in brand value, instead, judging their effectiveness by marketing mix modeling results on short term sales or bumps in intermediate measures such as awareness or purchase intention.

In the early 1980s, $50 billion or more was shifted by US marketers from advertising to trade promotion. The reason was that IRI and Nielsen made weekly store scanner data available that showed huge spikes in weekly sales when a trade deal (e.g. end of aisle display with price off) was run. A typical result was that only 5-10% of lift above baseline was associated with advertising. Obviously, trade dealing was the way to go.

In 2005, in an ANA Advertiser paper, I asked marketers to consider, “where did the baselines come from”? Why do some brands have 5-10X the baseline of their competitors? Maybe we should start focusing on the baseline as much as the spikes?

Professor Len Lodish noticed the same thing and in HBR 2007 co-authored a paper entitled, “If brands are built over years, why are they managed over quarters?” He notes that promotions lift sales but also reduce baselines and increase a brand’s price sensitivity. However as brand management rotates from brand to brand, they hit their numbers with effective promotion and by cutting the 4th quarter ad budget, leaving the problem for the next team.

The assessment? Marketers are mortgaging their brand’s future.

However, even if a marketer commits to measuring advertising’s impact on brand value, the path forward is unclear.

Lodish calls for a dashboard approach, where baselines are re-calculated regularly so the effect of brand-building can be assess against brand baselines and changes in price sensitivity. Unfortunately, excessive promotion will reduce the baseline making it appear that promotions are working and incorrectly concluding that a simultaneous ad campaign is reducing baseline, leading to more promotion and less advertising—reinforcing the exact wrong conclusion.

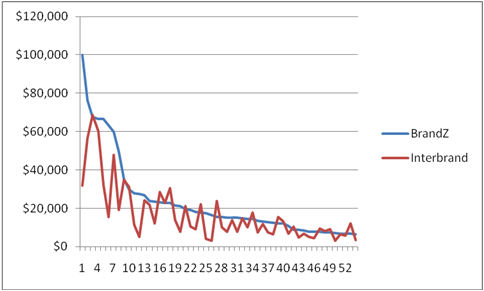

Another approach would be to calculate the financial value of a brand in a way that is trackable over time. However, at this point, two main ways the industry can choose to do brand valuation, BrandZ and Interbrand, produce quite different answers as shown in the following graph (2008 data) that depicts brand value (in millions) on those brands (ranked by Brandz valuation) in common to both sets of rankings.

Is Google worth $86 billion or $25 billion? Is Google worth much MORE or LESS that Microsoft? These discrepancies between the two methods would give marketers and CFOs pause to treat this as hard information upon which to base investment decisions unless one of the two methods is carefully validated by a given marketer.

Is Google worth $86 billion or $25 billion? Is Google worth much MORE or LESS that Microsoft? These discrepancies between the two methods would give marketers and CFOs pause to treat this as hard information upon which to base investment decisions unless one of the two methods is carefully validated by a given marketer.

A third class of tools comprises attitudinally-based measures of brand equity which can come from asking a magic brand equity question, attitudinal modeling, or conjoint/discrete-choice where the contribution to utility from the brand name alone is isolated. All valuable, but do they give an ROI? “I spent this much and I got this increase in the value of my brand, so this campaign was ROI-positive…” Probably not (yet).

Especially in recessionary times, marketers are tempted into make exactly the wrong decisions by cutting advertising and minimizing sales declines through promotions. This will have the long-term effect of cheapening national brands and mortgaging their future.

According to Brandz, the total value of the top 100 brands is close to $2 trillion. That is a huge amount of asset creation from advertising and other brand building investments and marketers need to find a way to make the connection or they will continue to make the wrong marketing investments.

Good article, Joel.

I share the concern that as real time sales tracking data become available in more industries some marketers will be seduced into running even more short term price and promotion tactics that fundamentally devalue the brand.

One correction. It wasn’t the availability of weekly Nielsen data that helped drive the shift from advertising to promotion spending in the CPG industry in the mid 80s, but rather the introduction of InfoScan, IRI’s national weekly scanner tracking service. At the time, Nielsen was more concerned about defending its bimonthly audit service than making available a scanning alternative.