The ARF chose the right theme for its AM8.0 conference…measuring the unmeasured. As smartphones and tablets disrupt how people use media to be entertained, learn things and to shop, the measurement gap is increasing.

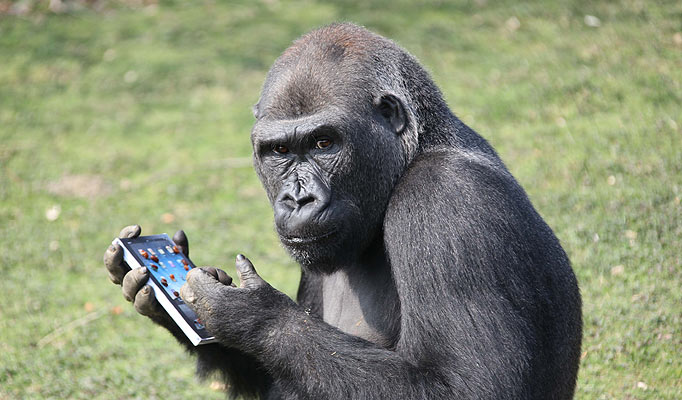

How important is it to measure multiplatform usage by consumers? Evidence provided to me in my interview with Gian Fulgoni, Chairman at comScore suggests that TV is now the 720 pound gorilla—still the biggest and hairiest beast, but maybe not quite as large relative to the other creatures in the jungle as it once was.

TV now needs digital to complete the reach it was once able to offer to advertisers on its own as consumers’ self-directed media behaviors continue to change. And computer based internet will need smartphones and tablets. But unless we measure this, how will we know?

And why should we care? I think the perspective is expressed a bit differently depending on which stakeholder group you talk to in the ecosystem. Today, in this blog, I will provide a supplier perspective via an interview with Gian Fulgoni, one of the speakers at Monday’s events.

Media companies. What I infer today’s presentation by ESPN was that the burning bed issue for a media company is the need to understand the true unduplicated reach of their content and properties, now available on at least 4 screens…TV, tablets, smartphones, computers plus radio. They need to know this to understand how consumers, especially their most engaged fans, choose to seek out their content. Unstated but inferred by me is that this understanding will be at the new heart of the selling narrative a major cross-platform media company will need to present to agencies and advertisers.

Research companies. For a research company like comScore or Arbitron, the cross-media measurement challenge becomes the ultimate game-changer. No longer can a research supplier rest on its laurels as currency for a particular media like TV or radio or internet, if the key questions are not contained within any single touchpoint but how the mix works collectively. It is the ultimate opportunity for a supplier to build a better mousetrap and disrupt the existing pecking order. And yet, credible offerings will not be easy to fashion. Marc Ryan, Co-CEO of Insights Express told me that the big challenge will be to get multiplatform measurement solutions to scale.

Advertisers. For a marketer, the key questions are how fast should I go into digital, and how? How can I determine the ROI of pieces of the media mix, especially since they are intended to work together in some synergistic way that makes their effects hard to disentangle. While the advertiser perspective was not given enough emphasis (IMHO) at the conference, Dave Poltrack from CBS championed the belief that marketing mix modeling, the marketer’s key ROI assessment tool, is broken. It does not adequately capture long term brand building effects, or the ability of a medium to deliver direct and INdirect effects. For example, TV not only can drive sales directly, it can drive search and social media conversation which in turn drive sales. Another perspective expressed by advertisers during my luncheon table discussion was that the picture of how to build brands and what brand success looks like in a digital age has changed but that new measurement models have not yet taken root.

To fully understand why cross-media understanding is critical, I spoke with Gian Fulgoni, Chairman of comScore.

Joel: why is cross-platform measurement important to advertisers? Why not just measure each platform individually the best way possible?

Gian: If we keep measuring each platform in a silo, we will have no idea of the cross-platform reach. Certain people are watching original scripted content online because it fits their schedule. Demos are different of these viewers. Mobile and tablets are now accounting for 48% of internet time so these platforms need to be understood. Time spent on the internet across all devices has doubled. If you are pumping in more money, it is better to be buying reach so valid measurement of the way that consumers use media across platforms is the only way to know this. ComScore has run simulations that show that if you take 10% of the TV budget and put it into online you will increase effective reach (those seeing a brand message 3+ times). For the 235 million people who access the internet, time online across all devices accounts for 46% of time spent watching TV. (US consumers spend 2 hours and 21 minutes online daily vs. approximately 5 hours per day watching TV.)

Joel: What does this mean for media research suppliers?

Gian: From a supplier POV, the need is acute, the opportunity is enormous but it is not easy to do as it challenges the traditional way of doing research, but we think we figured it out. The big thing is that you need both panel data and server/census data. (We now have our code on over 1MM domains). Originally, we started using server data to calibrate the clickstream panel but we also get so much more. Web analytics also tells us what device (computer, tablet, smartphone) is being used and this is an enormous asset for understand the big game changer, mobile. We also get IP address, which helps us link to TV set top data.

Next blog: the cross-platform media challenge from a media company perspective.